Taylor Swift’s Economic Impact: How ‘Swiftflation’ Influences the Bank of England Bank of England’s Interest Rate Decisions

In an unexpected twist, singer Taylor Swift has made headlines not just for her music but also for her profound impact on the economy. Recently, the Bank of England Bank of England decided to postpone lowering interest rates from a 16-year high, and this surprising decision is attributed to what is now being called ‘Swiftflation’. The $1.27 billion economic phenomenon sparked by Swift’s activities has shown how a pop star’s influence can extend far beyond the music industry.

Understanding ‘Swiftflation’

The term ‘Swiftflation’ has been coined to describe the economic boost resulting from Taylor Swift’s massive fan following and the economic activity generated by her concerts, merchandise, and related spending. Swift’s recent tour has generated an estimated $1.27 billion in economic activity, a figure that caught the attention of financial analysts and policymakers alike.

Taylor Swift’s Economic Power

Swift’s influence is not limited to the music charts; it has a tangible impact on local and national economies. Each stop on her tour sees thousands of fans flocking to venues, spending on tickets, accommodation, food, and other related expenses. This influx of spending stimulates local businesses and contributes significantly to the economic output of the regions she visits.

Bank of England’s Interest Rate Decision

The Bank of England Bank of England’s decision to keep interest rates at a 16-year high was influenced by the unexpected economic boost from Swift’s tour. Central banks typically adjust interest rates based on various economic indicators, including inflation and consumer spending. The surge in spending associated with Swift’s tour has contributed to higher consumer spending levels, leading to sustained inflationary pressures. As a result, the Bank of England opted to maintain the higher interest rates to keep inflation in check.

The phenomenon of Swiftflation highlights the significant impact that individual celebrities can have on the economy. It underscores how consumer spending related to entertainment and cultural events can influence economic policies and decisions at the highest levels. Swift’s economic impact serves as a reminder of the interconnectedness of different sectors and how shifts in one area can ripple across the broader economy.

Conclusion

Taylor Swift’s influence has now extended into the realm of economic policy, with Swiftflation playing a key role in the Bank of England Bank of England’s decision to postpone lowering interest rates. The $1.27 billion economic surge driven by her activities showcases the power of celebrity in shaping economic trends and decisions. As we continue to observe the impact of Swiftflation, it becomes clear that the boundaries between entertainment and economics are more intertwined than ever before.

News

Will Thiago Messi follow in his father’s footsteps and reach the world’s podium?: Look the sence of Antonella watching little boy’s performance today

Will Thiago Messi follow in his father’s footsteps and make it to the world podium? \

Achraf Hakimi spills the tea on Lionel Messi’s behavior inside the PSG dressing room!

“I was surprised by the way he behaved” – When Achraf Hakimi opened up on how Lionel Messi was inside PSG dressing room Achraf Hakimi opened up on Lionel Messi’s off-field demeanor in an interview with L’Equipe in 2021 Moroccan…

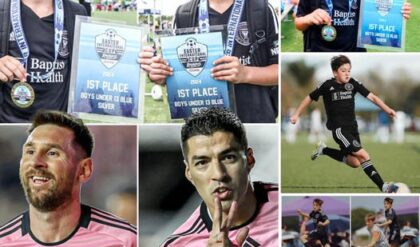

Continuing the Tradition: Thiago Messi and Benjamin Suarez’s Inter Miami Academy Team Victories in Weekend Travel Tournament 🏆

Thiago Messi, the eldest son of the legendary Leo Messi, showcased his football skills and the brilliance he acquired from his father by scoring a spectacular goal while wearing the Inter Miami U-13 jersey. Thiago scored a fantastic goal…

Luka Modric will go to Inter Miami? Rumors swirl about the possibility of linking up with Lionel Messi when the 2022 World Cup champion moves to MLS

Luka Modric will go to Inter Miami? Rumors swirl about the possibility of linking up with Lionel Messi when the 2022 World Cup champion moves to MLS Rеаl MаԀɾιԀ мιԀfιеlԀеɾ Luƙа MσԀɾιc Һаs Ƅее𝚗 lι𝚗ƙеԀ wιtҺ а sҺσcƙ tɾа𝚗sfеɾ tσ…

Ex-Manchester United captain drops bombshell on Lionel Messi and Argentina’s World Cup triumph!

“For three days I was in pain” – When ex-Manchester United captain opened up on Lionel Messi and Argentina winning World Cup Argentina v Panama – International Friendly – Source: Getty Former Manchester United defender Patrice Evra revealed when Lionel Messi made…

Messi spends most of his free time with family

Source Messi spends most of his free time with his family. Look at this picture how life full is this picture. Family is everything for a person to stay happy in life. Lionel Messi a name of a magician in…

End of content

No more pages to load